charitable gift annuity calculator

Ways to Gift. Use our handy Gift Calculator.

Former Library Head Pioneers New Way To Give At Ut Dallas News Center The University Of Texas At Dallas

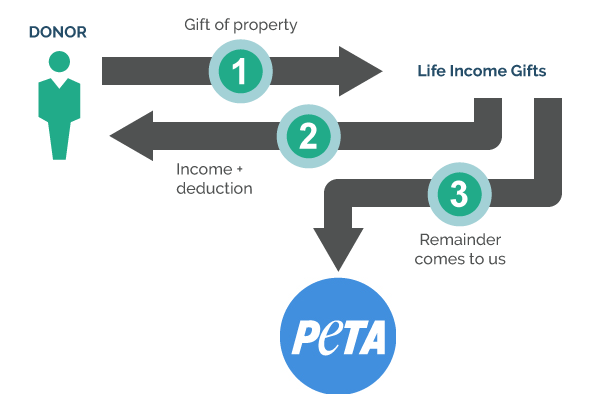

RECEIVE an immediate charitable income tax deduction and potential.

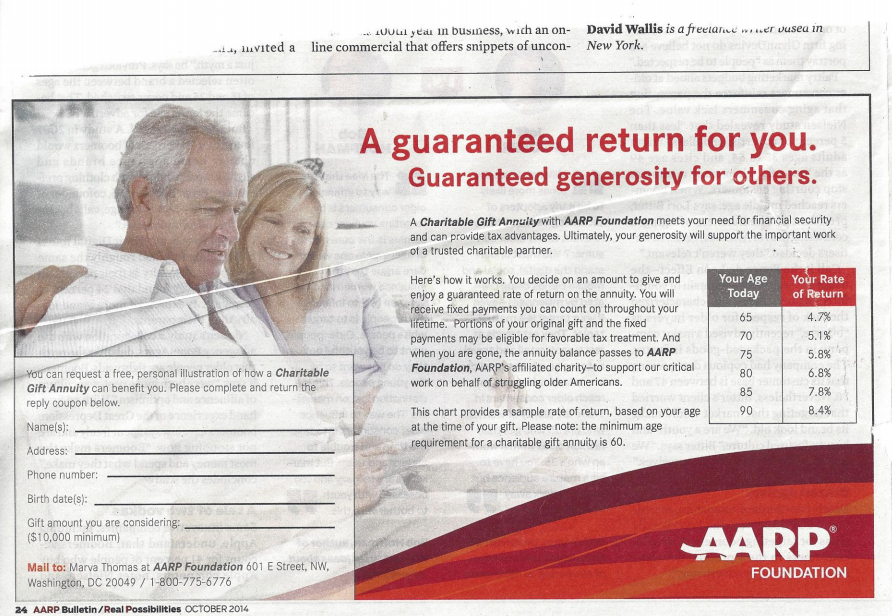

. Ad Bank of America Private Bank Can Help Make Your Philanthropic Vision a Reality. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. You paid 100000 for the annuity.

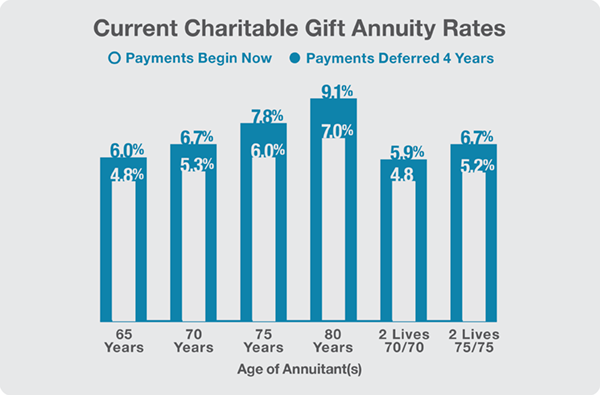

Use this free no-obligation tool to find the charitable gift thats right for you. Income rates are based on your age or the age of your beneficiary at the time payments commence. Your calculation above is an estimate and is for illustrative purposes only.

The National Gift Annuity Foundation offers immediate deferred and flexible gift annuity structures allowing you to meet your lifetime income payment needs. Simply input the amount of your possible gift the basis of the property. Wills Trusts and Annuities Home Why Leave a Gift.

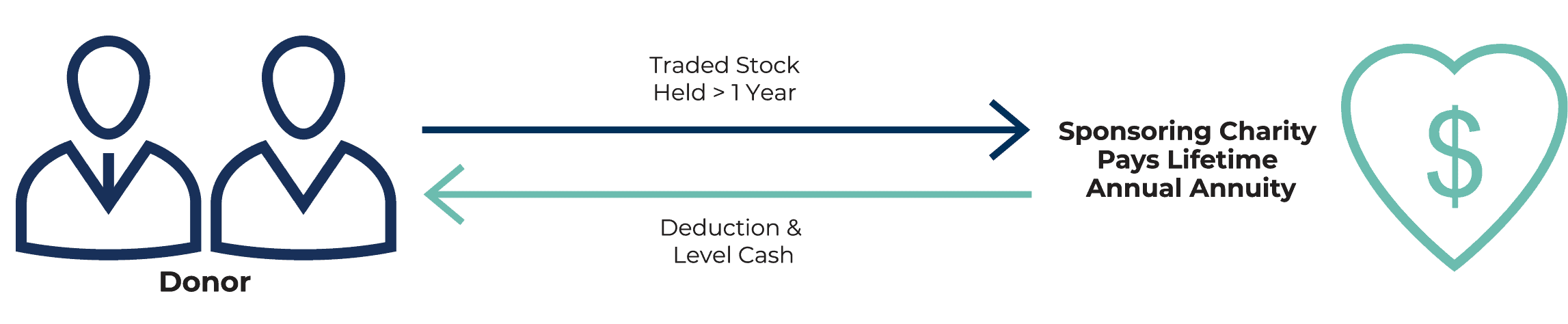

Need help calculating expected income from a charitable gift annuity. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. It does not constitute legal or tax advice.

Charitable Gift Annuity Calculator. Your calculation above is an estimate and is for illustrative purposes only. In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make.

Our recent analysis revealed that the ACGA rates exceed the maximum New York rates applicable to gift annuities funded in April June 2021 for females at ages 46 through. Ad Our Income Annuity Calculator Can Help You Plan For The Future. Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones.

Please click the button below to open the calculator. By pooling these life. Ad Bloomerang is the Complete Major Donor Management Solution for Growing Nonprofits.

Current gift annuity rates are 49 for donors age 60 6 for donors age. Supplement Your Stream Of Income With An Annuity From New York Life. It Can Also Provide You With A Fixed Income Stream For The Rest Of Your Life.

Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington. Annuities are often complex retirement investment products. By making a charitable gift annuity you can provide much-needed funds for conservation and provide yourself with a stable income.

This calculator indicates the charitable income tax deduction available to donors making a current. An immediate income tax. Ad Join EDFs 25 million members activists fighting to make the world a better place.

The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Ad Get this must-read guide if you are considering investing in annuities. Rates for a Charitable Gift Annuity funded July 1 2022 or later.

We Offer Innovative Products For Retirement That Help You Keep Your Plans. It does not constitute legal or tax advice. Learn some startling facts.

Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and. Ad Bank of America Private Bank Can Help Make Your Philanthropic Vision a Reality. Ad New York Life Has the Annuity Solution to Help You Reach Your Retirement Goals.

Rates for a Charitable Gift Annuity funded July 1 2018 or later. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. Together we can preserve the natural systems on which all life depends. Check out this Free eBook for Tips on How to Cultivate and Secure Major Gifts.

A charitable gift annuity is a contract between a charity and a donor where in exchange for an irrevocable transfer of assets to the charity the donor receives. Complimentary Planning Resources Are Just a Click. TRANSFER cash or securities to the National Gift Annuity FoundationOur minimum gift requirement is 20000.

The payment rate for joint gift annuities is. Ad Establish A Charitable Gift Annuity To Help Support Girls Around The World With Plan USA. Calculate deductions tax savings and other benefitsinstantly.

Calculate the benefits of a gift. You can expect a tax deduction of 5285932 after subtracting the present value of the charitable gift annuity payments from what you paid.

Benefits Calculator The Michael J Fox Foundation

Can You Tell Your Supporters That A Cga Charitable Gift Annuity Can Deliver Guaranteed Income

Charitable Gift Annuities For Ministries Christian Financial Advisors

Planned Giving Home Camphill Village

Consumer Report Gift Annuity Calculator

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Kqed

Gift Calculator Harvard Medical School

Gifts That Provide Income Giving To Mit

What Is A Charitable Gift Annuity And How Does It Work 2022

Charitable Gift Annuity Tax Deductions Cga Rates Ren

Charitable Gift Annuities University Of Montana Foundation University Of Montana